This makes it one of the best expense tracker apps out there, as you won’t need to individually fill in the amount every time. The FreshBooks app has a feature that lets you easily photograph and store receipts in the cloud, while automatically adding the expense to your books. Plus, if you scan your receipts you don’t need paper backups, according to Entrepreneur. There are many apps that make it easier to store receipts digitally. Remember, the IRS requires small business owners to keep their paper receipts, as well as any other supporting documentation like bank statements, for at least three years. Then you can reference back and see who you had lunch with on June 2 of the previous year. It’s a good idea to keep a detailed business calendar as a backup, whether on paper or in Google or Outlook. A receipt for a $10 sandwich six months ago won’t tell you much unless you write down that it was bought during a lunch with a specific client. If you have lots of receipts, organizing by category may make things easier come tax time.ĭon’t forget to write on your receipts what the purpose of the purchase was.

Buy plastic sleeves and label them by month or category. Tracking receipts will be so much easier with a dedicated filing folder for each category - personal, business, etc. Use either a filing cabinet or an accordion folder. At the beginning of the year, make one for each month and file your receipts accordingly. Friday afternoon is one option-and be sure to add this task as a recurring appointment on your calendar. If you can’t commit to filing your receipts daily, set aside time on a weekly basis to put those receipts away.

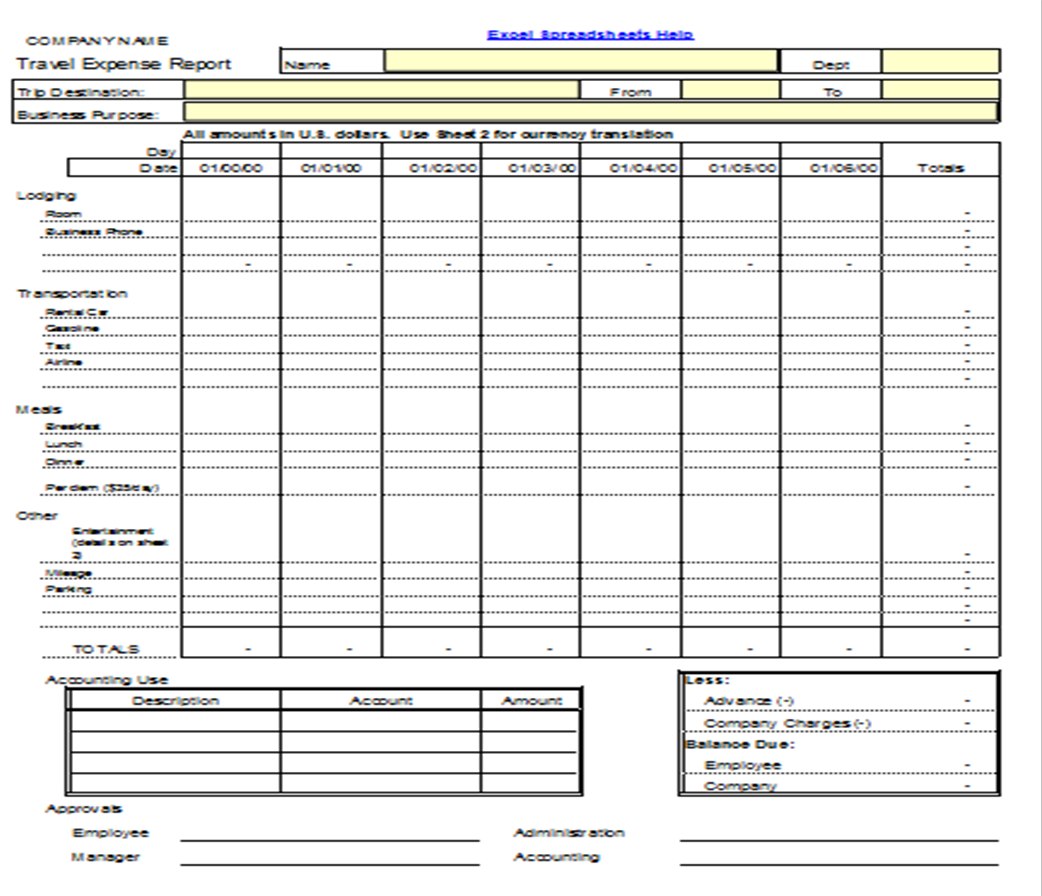

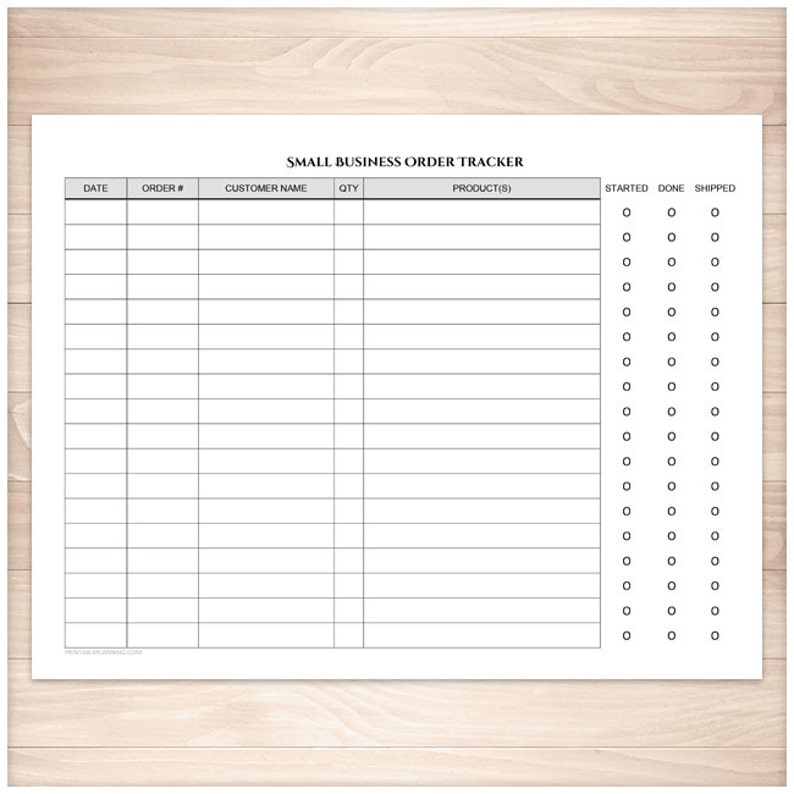

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. In this article, we’ll cover the following tips to track your business expenses: Keeping track of your expenses is imperative, as your capital dictates much day-to-day cash flow you have, as well as how much room your business has to grow. With the help of a business expense reporting app, you can easily keep on top of your daily expenses. This means you’ll pay less at tax time (or get more back). If you track your expenses on a regular basis you’re more likely to not miss potential deductions. Tracking your business expenses also makes tax time a lot simpler as many expenses can be claimed as write offs. And managing your expenses better will increase profitability. This will help you keep a closer eye on how much you’re spending as a small business owner. These tools will help make tracking business expenses a daily habit. Tracking business expenses is a lot less painful if you have the right tools.

0 kommentar(er)

0 kommentar(er)